Navigating the world of Medicare can feel like deciphering an ancient scroll, especially when you're trying to find a plan that truly fits your life. But what if you could find a Medicare Advantage option that not only covers the essentials but also adds a wealth of benefits designed to support your health journey comprehensively? That’s precisely what we're going to unpack today as we delve into Comparing Generations Advantage Benefits & Coverage – offering a clear, human-first guide to understanding what these plans offer and how they might serve your unique needs.

This isn't just about insurance policies; it's about empowering you to make informed decisions that impact your well-being, ensuring your health coverage adapts to the different stages and priorities of your life. Whether you're a new Medicare enrollee seeking comprehensive care, or looking to switch plans to better align with your lifestyle, understanding the nuances of these offerings is key.

At a Glance: What You'll Discover Here

- Holistic Wellness: Learn about valuable extras like a Wellness Wallet, covering fitness and more.

- Essential Health Services: Understand the robust dental, vision, and hearing benefits that go beyond basic Medicare.

- Convenience & Savings: Explore how quarterly Over-the-Counter allowances and prescription drug coverage can ease your budget.

- Plan Specifics: Get a detailed look at an example Generations Advantage HMO plan, including premiums, copays, and out-of-pocket maximums.

- Eligibility & Enrollment: Find out who qualifies and when you can sign up for these plans.

- Making the Right Choice: Practical tips on how to evaluate plans and leverage available support.

Beyond the Basics: What is Generations Advantage?

At its core, Martin's Point Generations Advantage offers Medicare Advantage (Part C) plans. These plans are an alternative to Original Medicare, provided by private insurance companies like Martin's Point, approved by Medicare. They bundle your Medicare Part A (hospital insurance) and Part B (medical insurance) benefits into a single plan. But where Generations Advantage truly shines is in its commitment to adding valuable "extras" that Original Medicare simply doesn't cover. This means going beyond basic medical care to support your overall health and quality of life.

Think of it as a comprehensive health partner, not just a payer of bills. These plans are meticulously designed to offer a robust suite of benefits, making it easier for you to prioritize both your acute and preventive health needs. Learn more about Martins Point Generations Advantage plans and how they enhance your Medicare coverage.

Tailored to Your Life: Understanding Core Benefits

One of the greatest strengths of Generations Advantage plans is their breadth of supplementary benefits. These aren't just minor perks; they represent significant savings and access to services crucial for maintaining an active, healthy lifestyle, often addressing common gaps in traditional Medicare.

The Wellness Wallet: Invest in Your Health

Imagine having an allowance dedicated to helping you stay fit and active. That's exactly what the Wellness Wallet offers. This allowance can be used for a variety of fitness-related expenses, empowering you to pursue activities that contribute to your physical well-being. Whether it’s a gym membership, exercise classes, or even specific wellness programs, this benefit acknowledges that staying healthy involves more than just doctor visits. It's about proactive engagement in your health journey, and the Wellness Wallet puts that power directly in your hands.

Dental Coverage: A Smile for Every Age

Oral health is a cornerstone of overall health, yet traditional Medicare typically doesn't cover routine dental care. Generations Advantage plans bridge this gap with robust dental coverage. Crucially, many plans offer this with no waiting period, meaning you can access benefits from day one. This coverage often extends beyond just cleanings to include essential services like fillings, crowns, and even more complex procedures. For many, this represents a significant financial relief and removes a major barrier to maintaining good dental hygiene, regardless of your age or current oral health status.

Vision & Eyewear: Seeing Clearly, Without the Strain

Clear vision is essential for daily life, from reading to driving to simply enjoying the world around you. Generations Advantage plans typically include a $0 annual eye exam, making it easy to keep up with crucial preventative care. Beyond the exam, you'll often find an allowance for eyewear expenses, which can be applied to frames, lenses, or contact lenses. This benefit is designed to help you manage the costs associated with maintaining good vision, ensuring you can afford the glasses or contacts you need without a significant out-of-pocket burden.

Hearing Aids & Services: Tune into Life

Hearing loss can profoundly impact social engagement and overall quality of life. Recognizing this, Generations Advantage plans often include allowances for hearing devices and services through partners like Amplifon. This partnership ensures you have access to a wide network of providers and a selection of quality hearing aids. The financial support for these often expensive devices can be a game-changer, allowing you to stay connected with loved ones and participate fully in conversations and activities.

Over-the-Counter (OTC) Allowance: Daily Essentials Made Easy

Everyday health and wellness products can add up, but with a quarterly Over-the-Counter (OTC) allowance, Generations Advantage helps ease that burden. This allowance can be used to purchase qualifying items, often numbering over 1,000, from common brands like CVS. From pain relievers and cold medicine to vitamins and first-aid supplies, this benefit provides a convenient way to stock up on household health essentials without dipping into your regular budget. It's a practical benefit that makes a real difference in managing daily health needs.

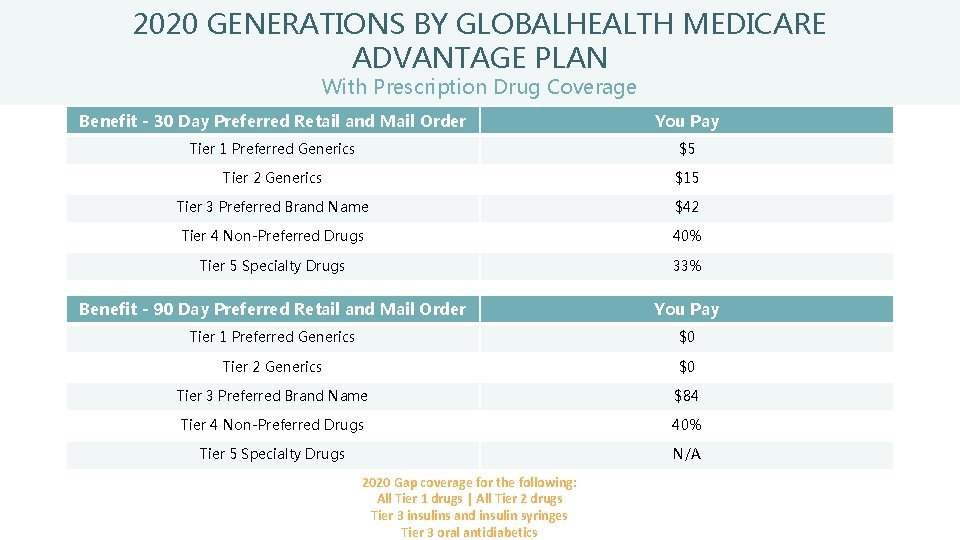

Prescription Drug Coverage (Part D): Navigating Your Meds

Many Generations Advantage plans include Medicare Part D prescription drug and vaccine coverage. This is a critical component for managing chronic conditions or simply staying healthy. These plans often feature low copays for common medications and boast a large pharmacy network, including convenient mail-order options. This structure aims to make accessing your prescriptions more affordable and hassle-free.

However, it's vital to remember that not all Generations Advantage plans include Part D. For instance, the specific plan H5591-003-0 for 2026, which we'll detail shortly, does not include a Medicare Part D plan for prescriptions. This distinction is crucial when comparing plans; if prescription coverage is a priority for you, be sure to confirm it's part of your chosen plan.

Decoding Plan Structures: An HMO Deep Dive (Example: Plan H5591-003-0)

To give you a concrete example of how Generations Advantage plans work, let's examine the Martin's Point Generations Advantage Alliance (HMO) Plan H5591-003-0 for 2026. This plan is rated a commendable 4.0 out of 5 stars by the Centers for Medicare & Medicaid Services (CMS), indicating a strong performance in areas like member experience, quality of care, and plan administration. With approximately 8,733 members, it's a well-established choice for many.

What "HMO" Means for You

Plan H5591-003-0 is a Health Maintenance Organization (HMO) plan. In an HMO, you typically choose a primary care provider (PCP) within the plan's network who coordinates your care. You generally need a referral from your PCP to see a specialist, and you must use healthcare providers and facilities that are part of the plan's network, except in cases of emergency or urgent care. This structure helps manage costs and ensures coordinated care, but it also means less flexibility if you prefer to see providers outside the network.

The Zero-Premium Appeal

One of the most attractive features of Plan H5591-003-0 is its $0.00 monthly premium for 2026. This means you don't pay an additional monthly fee to Martin's Point for this plan. However, it's crucial to remember that members must continue to pay their Medicare Part B premium. This detail is often a point of confusion; a $0 Medicare Advantage premium doesn't mean you stop paying for Part B.

Understanding Your Out-of-Pocket Maximum (MOOP)

Every health plan has limits, and a key one is the annual in-network out-of-pocket maximum (MOOP). For Plan H5591-003-0, this is $5000.00. This figure represents the most you would have to pay for covered medical services from in-network providers in a calendar year. Once you reach this limit, the plan covers 100% of your in-network care costs for the remainder of the year. Understanding your MOOP is vital for budgeting and knowing your financial exposure in a year with significant health events.

Breaking Down the Costs: Copays and Your Budget

Beyond the premium and MOOP, understanding your copays for various services is essential for predicting your healthcare expenses. Generations Advantage plans, like H5591-003-0, are designed with transparent cost-sharing structures.

Primary Care & Specialists: Routine Visits

- Primary Care Visits: For Plan H5591-003-0, you'll pay a $0 copay for visits to your primary care physician. This encourages regular check-ups and preventative care without an upfront cost barrier.

- Specialist Visits: When you need to see a specialist, the copay is a modest $15. This keeps access to specialized care affordable, provided you have a referral if required by the HMO plan.

Urgent Care & Emergencies: When Time is Critical

- Urgent Care Services: Life happens, and sometimes you need care quickly but it's not a full-blown emergency. Plan H5591-003-0 offers a $0 copay for urgent care services, making it easy to seek timely attention for non-life-threatening conditions.

- Ambulance Transportation: In an emergency, swift transport is key. The copay for ambulance services is $325. While a higher cost, it’s a necessary provision for critical situations.

Hospital Stays & Skilled Nursing Facilities (SNF)

Medicare Advantage plans cover inpatient hospital stays and skilled nursing facility (SNF) care, which are crucial components of serious medical events or recovery. The specific costs for these will vary by plan, but they are clearly outlined in the Evidence of Coverage (EOC).

Specialized Care: Mental Health, Rehab, Equipment, & Diagnostics

Generations Advantage plans, including H5591-003-0, are comprehensive, covering a broad spectrum of services:

- Preventive and Wellness Benefits: Many are covered 100% as a Medicare Part B benefit, promoting proactive health management.

- Mental Health Services: Essential for overall well-being, these services are included.

- Rehabilitation Services: Physical, speech, and occupational therapy are covered to aid recovery and improve function.

- Medical Equipment and Supplies: This includes necessary items like diabetes supplies, durable medical equipment (DME), and prosthetics.

- Diagnostic Services: Lab tests, X-rays, and advanced imaging are covered to help diagnose and monitor conditions.

- Chemotherapy and Part B-Covered Drugs: For those needing cancer treatment or other medications administered in a clinical setting, these are included.

This extensive list demonstrates the depth of coverage, designed to support members through various health challenges and maintain their independence.

Who Qualifies? Eligibility & Enrollment Periods Explained

Enrolling in a Generations Advantage plan means meeting specific criteria and understanding the timing of enrollment periods. This process ensures you get the right coverage at the right time.

The Basics: Part A, Part B, Service Area

To qualify for enrollment in a Martin's Point Generations Advantage plan, you must meet three fundamental requirements:

- Entitled to Medicare Part A: You must be eligible for or already receiving Medicare Part A benefits.

- Enrolled in Medicare Part B: You must be enrolled in Medicare Part B.

- Live within the Plan’s Designated Service Area: Medicare Advantage plans are geographically restricted. You must reside in the specific counties or regions where the plan is offered.

Key Enrollment Windows: IEP, AEP, MA OEP, SEP

Medicare enrollment isn't a free-for-all; there are specific periods during which you can enroll or make changes:

- Initial Enrollment Period (IEP): This is your first opportunity to enroll in Medicare, typically around your 65th birthday. It spans seven months: the three months before you turn 65, the month you turn 65, and the three months after.

- Annual Enrollment Period (AEP): Also known as the Open Enrollment Period, this runs annually from October 15 to December 7. During AEP, anyone with Medicare can join, switch, or drop a Medicare Advantage plan. Coverage begins January 1 of the following year.

- Medicare Advantage Open Enrollment Period (MA OEP): This period runs from January 1 to March 31 each year. If you're already in a Medicare Advantage plan, you can use this time to switch to a different Medicare Advantage plan or switch back to Original Medicare.

- Special Enrollment Periods (SEP): These periods are granted for certain life changes, such as moving to a new service area, losing other coverage, or qualifying for Extra Help with prescription drug costs. SEPs allow you to make changes outside of the standard enrollment periods.

How to Enroll: Your Options

Once you've determined your eligibility and chosen your plan, enrolling is straightforward. You can typically complete enrollment in a few ways:

- Online: Many plans offer convenient online enrollment.

- With a Licensed Insurance Agent: Agents can provide personalized guidance and help you navigate the options.

- Directly with the Plan: You can contact Martin's Point directly to enroll.

Choosing the right time and method for enrollment ensures a smooth transition to your new coverage. Explore the range of Martins Point Generations Advantage plans available in your area.

Making Your Choice: Beyond the Brochure

Selecting a Medicare Advantage plan is a personal decision that should be based on your specific health needs, budget, and lifestyle. While brochures provide a snapshot, truly understanding your plan requires a deeper look.

Why the Evidence of Coverage (EOC) is Your Best Friend

The Evidence of Coverage (EOC) document is the definitive guide to your plan. While marketing materials highlight key benefits, the EOC provides the full, legally binding details on plan coverage, costs, and benefits. It outlines what's covered (and what isn't), your cost-sharing responsibilities, rules for using providers, and your rights as a member. Before making any final decision, always review the EOC for the specific plan you're considering. It's the ultimate source of truth for your coverage.

The Power of Local Support: When to Call a Specialist

Navigating Medicare can be complex, and you don't have to do it alone. Martin's Point offers local benefit specialists who are available to provide assistance. These specialists can answer your questions, help you understand specific plan details, and guide you through the enrollment process. Don't hesitate to call them directly if you have questions or need personalized advice (TTY: 711 for hearing impaired). Their expertise can be invaluable in ensuring you make the best choice for your health needs.

Frequently Asked Questions (FAQs)

We've covered a lot of ground, but a few common questions often arise when comparing Medicare Advantage plans.

Do all Generations Advantage plans include Part D?

No, not all Generations Advantage plans include Medicare Part D prescription drug coverage. As highlighted with our example Plan H5591-003-0, some plans focus solely on medical benefits (Part A and B) and the extensive supplemental benefits. If prescription drug coverage is important to you, it's crucial to verify that the specific Generations Advantage plan you're considering explicitly includes Part D. If it doesn't, you might need to consider enrolling in a separate standalone Part D plan (if allowed by your MA plan type).

How important are CMS Star Ratings?

CMS (Centers for Medicare & Medicaid Services) Star Ratings are incredibly important! They provide an objective measure of a plan's quality and performance. Plans are rated on a scale of 1 to 5 stars, with 5 stars being excellent. These ratings consider factors like:

- Quality of Care: How well the plan helps members stay healthy and manage chronic conditions.

- Member Experience: How easy it is to get appointments, customer service, and grievance processing.

- Plan Administration: Accuracy of claims processing and overall operations.

A higher star rating, like the 4.0 for Plan H5591-003-0, indicates a plan that generally performs well across these critical areas and provides a good experience for its members.

Your Next Steps: Taking Control of Your Health Coverage

Choosing a Medicare Advantage plan like those offered by Martin's Point Generations Advantage is a significant decision. By understanding the breadth of benefits—from the Wellness Wallet and robust dental coverage to vision, hearing, and OTC allowances—you're better equipped to select a plan that genuinely supports your holistic health. The detailed example of Plan H5591-003-0 illustrates how these plans combine comprehensive medical coverage with appealing cost-sharing and valuable extras.

Remember, the goal is to find a plan that not only covers your medical necessities but also enhances your quality of life. Don't underestimate the value of those "extra" benefits; they can lead to substantial savings and better health outcomes over time. Take the time to review the Evidence of Coverage, utilize local benefit specialists, and compare your options carefully. Your health is worth it.

Discover how Martins Point Generations Advantage can align with your personal health needs.